“If the boys stopped torpedoing democracy, burning through global resources, and treating real life like The Boys LARP session… we could actually use their combined $773 billion net worth to: eradicate global hunger, fund universal education, end homelessness.”

The Tech Bro Funhouse

The tech industry loves to brand itself the ultimate disruptor—reinventing the wheel, “breaking the internet,” and solving problems nobody asked for via billion-dollar apps nobody needed. Somewhere between Web3 hype and the AI arms race, though, the narrative got twisted. Silicon Valley quietly decided it didn’t need ethics, equity, or any connection to real human problems.

Honestly? The delusion is exhausting.

The survivors of the dot-com crash now have such obscene wealth they literally can’t stop performing it. They’re blackout-posting from space, renaming Twitter like it’s some midlife crisis Tesla truck, and grinning like animatronic lizards during congressional hearings on child protection.

In the meantime, America is spiraling. One tantrum-prone tech demigod with a rocket has decided governance should run like one of his startups: erratic, ego-fueled, and catastrophically unmoderated. He’s hoarding social platforms like fantasy trophies, decimating departments (accessibility first, naturally), and then shrugging when everything becomes a fascist meme swamp. The result? A government that now feels like X post-firing spree: glitchy, hostile, and run entirely on vibes (and unpaid interns).

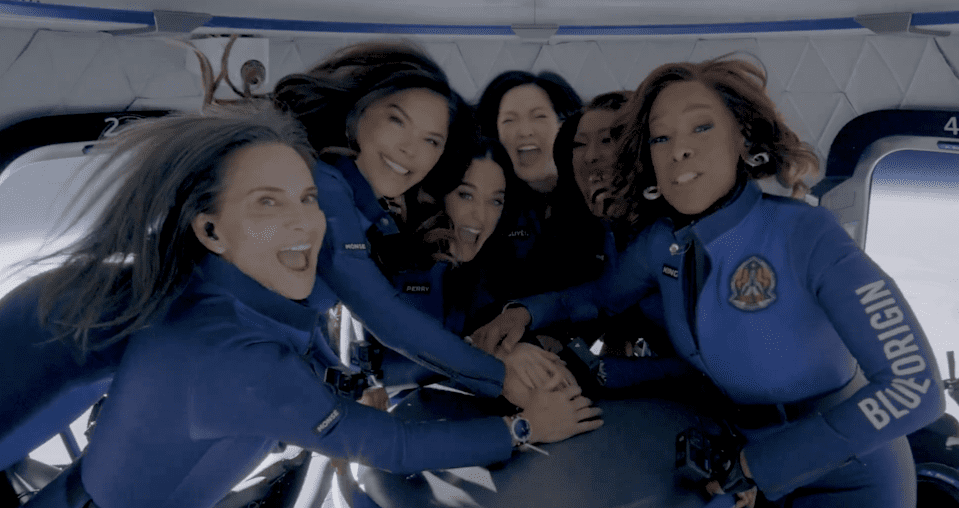

Meanwhile, his billionaire peer is planning a $600 million wedding in Venice — yes, Venice, the UNESCO-sinking, overtouristed, luxury-apocalypse site — with a “glam” space vacay on the side. Not for science. Not for progress. Pure flexing for the feed. A $20 million stunt.

Count on Olivia Munn to always say it best in a recent interview on Today “I know this is not the cool to say…I think it’s a bit gluttonous” Yes. Yes it is a bit gluttonous.

Let’s talk scale. One Blue Origin suborbital ride reportedly ranges from $16.7 million to $20 million (or higher, depending on source)¹. That same cash could:

Vaccinate 50 million children

Provide clean water to 400,000+ people

Distribute millions of mosquito nets to prevent malaria

But instead? We watch rockets masquerade as philanthropy.

And then there’s the OG of tech duderism: the man who made hundreds of billions rating his classmates’ “hotness.” His platform evolved from gross objectification to enabling misinformation and genocide — because moderators didn’t even speak the language they were supposed to filter. Now he wants to lead AI. Make it make sense.

Combined, Musk, Bezos, Zuckerberg (et al.) control an estimated $773 billion — enough to end hunger, fund universal education, and multiple times over eradicate homelessness in the U.S. Instead, they’d rather destabilize democracy, burn the atmosphere, and run life like a gangster LARP. Because apparently being rich also means being deeply, irreversibly weird.

So: what if someone else held those billions?

What If Women Had That Money?

Let’s be real. Being rich doesn’t also mean you have to be deeply, irreversibly weird and if that kind of über wealth and undeserved influence were concentrated in women’s hands, the vibe would very likely be radically different.

So let’s play a little what if.

The three richest women — Alice Walton, Françoise Bettencourt Meyers, and MacKenzie Scott — hold a combined net worth of ~$215 billion. Still insane. Still unjust. But a fraction of their male counterparts. By some crazy miracle they’ve managed to not spend it all on space cowboy cosplay or trolling epidemiologists online. You might say that they’re more Devil Wears Prada evil than actual Dr. Evil evil.

In fact, MacKenzie Scott has already given away more than $16 billion—quietly, with no branding exercise, and zero rockets. Imagine that.

I want to be very clear. I’m absolutely not trying to downplay their imperfections. They still benefit from and participate in global systems that rely on exploitation, unpaid labour, and low-wage supply chains. We see it. But at the very least, they’re not actively destabilizing society for giggles, shits and stock bumps.

Why Women-Led Ventures Hit Different

Neither Alice, Françoise, or MacKenzie are directly involved in tech, however, it is a fact that when women build tech, we get different outcomes. Not perfect. But smarter. More human. More useful. And, as it turns out, way more profitable.

So why aren’t we funding them?

According to Forbes:

“Companies with at least one female founder deliver 35% higher ROI and 12% higher revenue than male-founded peers.”

And yet, of the $45 trillion in global tech investment, women-led startups receive less than 3% of venture capital funding. That’s right: less than three percent. Let that sink in.

Less than 3%!!?

Meanwhile, over in Europe, the numbers are actually improving. Between 2010 and 2022, 15% of women-led deep tech startups received seed funding, and in 2024, that number jumped to nearly 33%. What’s their secret?

You’re not gonna like it.

It starts with a “D,” ends in “I,” and makes alt-bros spontaneously combust.

Europe’s DEI Advantage: How Policy Actually Works

The European Secret Sauce:

- Government-backed mandates for gender equity in funding programs like Horizon Europe, the EIC, and EIT. (Fun fact: as part of the Commonwealth, Canada is eligible for select Horizon and EIC programs—and has already received over €6 million.)

- Government-led incentives for investors backing women-led startups—think tax breaks, co-investment guarantees, and training programs.

- Well-funded incubators focused specifically on women in innovation (e.g. Female Founders, EIT’s Women Entrepreneurship programs, Women in Deep Tech).

- Public accountability—European institutions and media actively call out gender inequality, creating pressure for funders to get their act together.

- Annual reporting—the EU releases detailed reports on gender equity in business and innovation funding every single year.

Where are my Canadians at? As a Commonwealth member, we’re eligible for some of these programs—and have already received over €6 million from Horizon Europe.

Possibly the most impactful difference is that many European investors take a long-term view. They’re more likely to fund interdisciplinary, scientifically grounded, or impact-focused startups—exactly the kind of ventures where women founders tend to thrive.

In contrast, U.S. venture capital is often stuck in “grow fast or die trying” mode, biased toward hyper-aggressive pitches and hoodie-slinging confidence, which often favours men.

And yet somehow, in certain circles, we’re still pretending that following a DEI model is what caused the collapse of the European economy, starved the “merit-based” talent pool, and made all the planes fall out of the sky. All of them. Every single one.

I think you know that’s not what happened.

Not even close.

Feminism Isn’t Just Ethical—It’s Profitable

Let’s look at the numbers:

- BCG found that women-founded startups generate 10% more cumulative revenue over five years.

- First Round Capital reported that companies with at least one female founder perform 63% better than all-male founding teams.

- Kauffman Fellows found women-led ventures–especially in tech–generate 35% higher ROI.

- And women-led startups tend to do all that with a third less capital.

The lack of investment is not due to a lack of talent, or even a lack of ideas. It’s a lack of imagination from the people holding the purse strings.

We don’t need another “Year of the Woman” headline. We need capital. Vision. Equal footing.

A Tiny Silver Lining?

In a small twist of logic-defying optimism, research shows that deep tech startups with at least one woman on the founding team tend to receive first-round funding faster than all-male teams.

That is—of course—assuming they’re in that pesky, inescapable 3%.

What is Gender-Smart Investing and Why is it So Smart?

Gender-smart investing is exactly what it sounds like: investing with your damn eyes open. It’s a strategy that intentionally puts money into women-led, gender-inclusive companies—because it’s good for business and for humanity.

But this isn’t just a feel-good move. It’s one of the most impactful levers we have to shift economic power and fund the kind of innovation that actually improves lives. Not just for women and girls—for everyone. Because when you invest in half the population, you unlock all of the world’s potential.

To be considered gender-smart, an investment should tick at least a few of these boxes:

- Founded or led by women and/or gender-diverse leaders

- Built on an equitable, inclusive workforce model

- Actively designs products/services with women’s needs in mind

- Operates without causing harm to women and girls in supply chains or communities

- Supports gender equity through its hiring, governance, or mission

You don’t need to have a million bucks in the bank to invest. Whether you’ve got $5, $500, you can start investing in a better future right now. Because capitalism isn’t going anywhere. So we might as well use it to fund the world we actually want to live in.

Where to Start: Gender-Smart Platforms

A basic Google search, a scroll through Kickstarter, or a well-aimed question on Reddit can turn up dozens of women-led tech startups, BIPOC-founded platforms, and gender-inclusive companies looking for funding or support. And every time you back one of those companies—whether with dollars, signal boosting, or pre-orders—you’re participating in the redistribution of power.

Here’s a shortlist of our favourite women-owned and women-led investing platforms to help you begin your gender-smart journey:

Ellevest

Founded by Sallie Krawcheck, Ellevest is a robo-advisor built for women, taking into account realities like the gender pay gap, longer lifespans, and career breaks. Smart, sleek, and fully mission-aligned.

IFundWomen

A crowdfunding and grant platform where you can directly fund women entrepreneurs. You can support a founder, donate to a grant pool, or crowdfund your own project.

Coralus (formerly SheEO)

A Canadian-founded, globally active community of women and non-binary folks investing in women-led ventures through a pay-it-forward model. Think: radical generosity meets economic justice.

Her First $100K / The Treasury

Founded by Tori Dunlap, this platform offers financial education, investing tips, and a values-aligned private community called The Treasury, built for first-gen investors and feminist wealth builders.

FemInvest

Based in the EU, FemInvest is focused on financial literacy and wealth-building for women. Great for global readers, beginners, and those looking for a community-first learning environment.

Whether you’ve got $5, $500, or just a browser and a bookmark folder, you can start investing in a better future right now. Gender-smart investing isn’t a niche trend—it’s a necessary shift. And the more of us who participate, the faster it scales.

Why Feminism in Tech Investment Matters (Besides the Obvious)

Diverse Teams Make Smarter Tech

Remember when early health-tracking apps forgot half the population exists? Yeah, awkward. Turns out, when you don’t include women in decision-making, you get some pretty half-baked ideas and often end up looking like a moron. Gender diversity isn’t a woke checkbox—it’s the secret sauce to creating products that actually work for everyone.

Take fitness tracking apps. Early versions ignored menstrual cycles—because, apparently, no one thought that might be relevant. PayPal entrepreneur Max Levchin took a go at it with Eve, a period tracking app, and Glow, for women trying to conceive. Miranda Hall wrote a really great piece for Vice on her take of the period tracker, Eve. Spoiler: It was not a “glow”ing review (Womp Womp).

I would be totally gobsmacked if there wasn’t at least one women-led startup trying to get a period app off the ground before Mr. Levchin and had that hypothetical app been funded perhaps that blunder wouldn’t be the yard stick that we’re still holding period apps to to this day. if there wasn’t a women-led team s to fix that blunder and create something actually useful. Crazy how representation works, huh?

Now, let’s take it beyond fitness apps. From AI algorithms that fail to recognize female voices to crash-test dummies designed for male bodies, the industry has repeatedly overlooked half the population. Investing in women-led tech companies isn’t just a nice thing to do—it’s a necessity if we want smarter, more inclusive innovation.

Betting on Women Is Betting on the Future

This isn’t just about warm, fuzzy feelings—it’s about making bank. Studies show gender-diverse teams are more innovative, more profitable, and more likely to make investors look like geniuses. One VC even put it bluntly: “Betting on women is the surest way to double your money.”

And let’s not forget the ripple effect. Women entrepreneurs tend to reinvest in their communities, boosting local economies and lifting up others. More money in, more impact out. It’s a win-win-win.

Beyond financial returns, investing in women-led businesses future-proofs the market. Women drive 70-80% of consumer spending, so it only makes sense that products should be developed with them in mind. Ignoring this segment? That’s just leaving money on the table.

When we fund women, we get:

- Canva (co-founded by Melanie Perkins, now valued around $49 billion)

- Femme Gaming (Christine Gauthier)

- SafeHer (Tiffany Jackson)

- Clue (Ida Tin)

- Tali AI (Dr. Anju Mathew) *Canadian*

- Unspun (Beth Esponnette)

All of them almost didn’t make it—because the system didn’t think they were worth betting on.

Tech Shapes the World—Let’s Not Mess This Up

The platforms and tools we build dictate how we communicate, shop, and live. Investing in feminist-driven tech means making sure those tools serve everyone—not just a select few who look like they walked straight out of a Silicon Valley casting call.

Take Glossier’s community-driven beauty brand or Ellevest’s women-first investment platform. These weren’t just pink-washed versions of existing ideas; they rewrote the playbook. That’s what happens when you put diverse minds in the driver’s seat.

And let’s be real—representation matters. The next generation is watching. When they see women leading the charge in tech, they see new possibilities. Feminism in investment isn’t just about fixing today’s mess; it’s about coding a better future.

Investors: Time to Update Your Operating System

So, what’s the fix? A few simple upgrades:

- Diversify Your Portfolio: If you’re not funding women-led startups, you’re literally leaving money on the table. Bad business move.

- Challenge Your Biases: Yes, you have them. We all do. Time to implement bias training and transparent funding criteria. And if your VC firm looks like a dude-heavy startup retreat, maybe mix it up?

- Expand the Network: Women entrepreneurs often don’t have the same access to ‘warm intros’ that their male counterparts do. Be a connector. It’s not hard.

- Support Female-Led Funds: More women in venture capital means more investments in women-led businesses. It’s a simple equation with powerful results.

Oh, and let’s not forget—women founders shouldn’t have to pitch like they’re applying for a mortgage just to get the same consideration as their male peers. Let’s level the playing field, shall we?

Fixing the System: No, A Diversity Panel Isn’t Enough

Throwing a few women into the mix and calling it a day? Not gonna cut it. Real change looks like this:

- Policy With Teeth: Governments should incentivize gender-equitable investing with actual benefits. If tax breaks work for billion-dollar corporations, why not for investors backing women-led businesses?

- Corporate Transparency: If companies aren’t tracking gender diversity in their investments, they’re not serious about change. Show us the receipts.

- Grassroots Initiatives: Women-focused accelerators, pitch competitions, and funding programs actually work. More of this, please.

- Women in Leadership: The venture capital world won’t change until women are calling the shots. Tired of seeing diversity panels with zero women? Yeah, same.

- More Media Coverage: Highlighting successful women-led companies can inspire more investors to follow suit and break the cycle of underfunding.

Why Now? Because the Future Can’t Wait

The world is shifting. Consumers want companies that reflect their values. Investors want bigger returns. And tech desperately needs solutions that serve everyone. Feminism in tech investment isn’t a trend—it’s the future.

And let’s be honest—big problems require big thinkers. Climate collapse. Surveillance capitalism. Health crises. Inequality. Women-led startups are already tackling them. The question is: will we fund them?

What’s Next?

Feminism in tech investment isn’t about slapping a pink ribbon on a funding round and calling it progress. It’s about creating an industry that actually reflects the world we live in. When women have equal opportunities to innovate, we all win—with better products, sharper ideas, and solutions that actually solve problems.

So, let’s stop pretending this is some niche issue. If we want an industry that’s as bold, creative, and forward-thinking as it claims to be, it’s time to put our money where our mouth is.

The next step is clear: action. Whether you’re an investor, a founder, or just someone who wants a better future, demand more. Because the future of tech depends on it—and honestly, we’re overdue for an upgrade.

The tech industry likes to think of itself as the ultimate disruptor, pushing boundaries and redefining the world as we know it. But there’s one area where it’s painfully stuck in the past: gender equity. Feminism in tech investment isn’t just about righting historical wrongs—it’s about creating a future that actually works for everyone. And guess what? That’s not just good ethics; it’s good business.

Closing

Because here’s the thing: the 3% funding stat is most glaring in tech, but the inequity doesn’t stop there. Women-led businesses across industries — from climate science to craft co-ops, from software to storefronts — face the same barriers, the same bias, the same underestimation.

Tech makes the gap visible because the numbers are so brutal and the stakes are global. But feminist investment isn’t just a tech survival strategy. It’s an everywhere survival strategy.

When we fund women-led companies of all kinds, we get better outcomes: stronger communities, smarter products, sustainable economies. The point isn’t just who codes the next app — it’s who gets the resources to build the future.

So whether it’s a founder pitching AI with ethics at the centre, or a collective launching a feminist print shop, the question is the same: who are we willing to bet on? And if the answer keeps being the same hoodie-clad bros, then the system isn’t broken — it’s rigged.

Time to fund differently. Time to build differently. Because the world we’re living in depends on it.

Share this piece, tag it with #newgirlarmy, and pass it on to your favourite rebel.

For more like this, sign up for The Edit, our newsletter for midnight thinkers, creative schemers, and unapologetic weirdos.

→ Subscribe to The Edit

→ Submit your story

→ Follow @shezinemagazine

Sources:

Blue Origin ticket cost: Yahoo article “What Is the Cost of a Blue Origin Flight?” (suggested range) Yahoo

BCG “Why Women-Owned Startups Are a Better Bet” (capital efficiency, ROI) BCG

Forbes “10 Stats That Build The Case For Investing In Women-Led Startups” Forbes

HBR: “Women-Led Startups Received Just 2.3% of VC Funding in 2020” Harvard Business Review

First Round Capital performance of female-led firms (cited in multiple summary articles) World Economic Forum

Kauffman Fellows / Women 2.0 capital efficiency stats Kauffman Fellows

NBER / 2025 study on failure/penalty bias (from news summary) Investopedia

European deep tech funding data (seed funding share) – you may need to search EIT / EU reports

Accelerating Equity — study on gender gap in VC, obstacles like relocation/family burden arXiv

EIF Gender Smart Equity Investment Programme — check EIF site

InvestEU gender-smart criteria — check InvestEU documents

Horizon Europe / Canadian participation data — check official grants portals

AXO (she/her) is a multidisciplinary creator, editor, and builder of feminist media ecosystems based in Toronto. She is the founder of She Zine Mag, Side Project Distro, BBLGM Club, and several other projects under the AXO&Co umbrella — each rooted in DIY culture, creative rebellion, and community care. Her work explores the intersection of craft, technology, and consciousness, with an emphasis on handmade ethics, neurodivergent creativity, and the politics of making. She is an advocate for accessible creativity and the power of small-scale cultural production to spark social change. Her practice merges punk, print, and digital media while refusing to separate the emotional from the practical. Above all, her work invites others to build creative lives that are thoughtful, defiant, and deeply handmade.